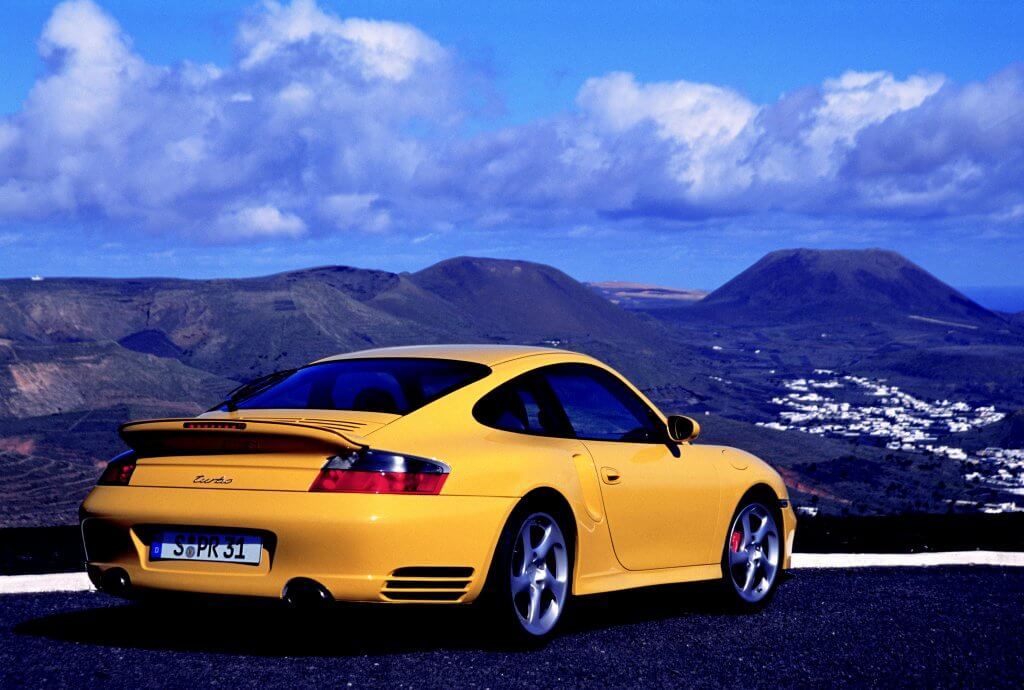

Overview

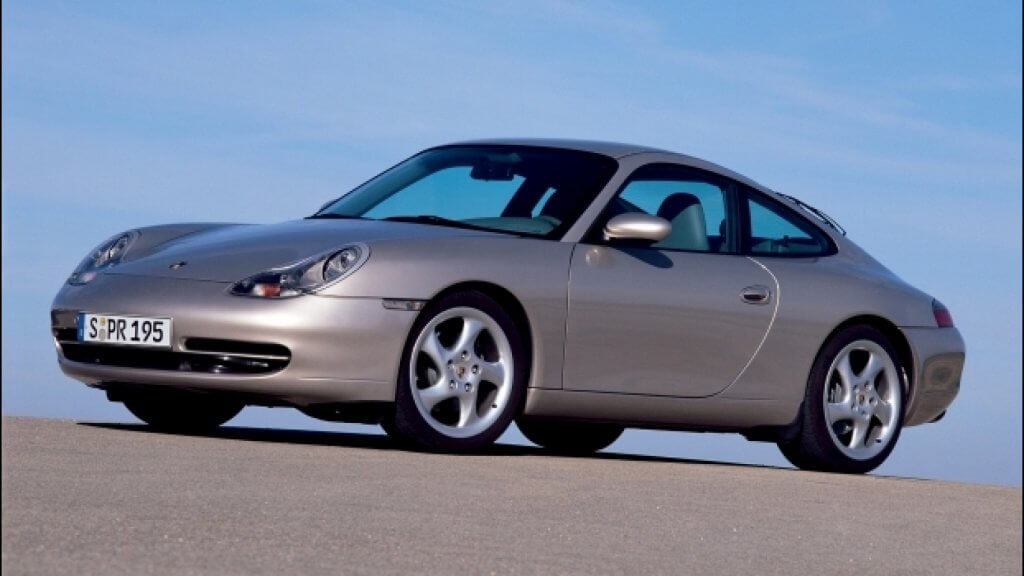

This must be the least loved of all 911 generations: purists (who rarely buy cars, but prefer to vent their anger publicly) hated its liquid-cooled engine, its modern pedal layout and the look of its headlights shared with the 986 Boxster. We can now say that they were all wrong. The 996, launched in 1997, was 80 kg lighter than the preceding 993, had a 50% stiffer body and was very successful, selling 175,000 units over ten years. Numerous changes to the driving experience made the car’s performance more accessible to new customers, and sharing the front part of the body structure (forward of the A-pillar) with the 986 Boxster saved the Porsche company from extinction: a great feat by Wendelin Wiedeking. 38% of parts were shared with the Boxster, no mean feat of engineering.

The underrated car is the cheapest way of getting into 911 ownership and is much better than the numerous internet “opinions” suggests. In recognition of that, the values of the facelifted version (2001) have already started to rise. The Turbo and the GT3 are real gems, especially the latter, as it is light and has an uncanny balance. The 996 is more suitable for novice supercar drivers than any of its predecessors due to its longer wheelbase (better high-speed stability) and the inclusion of electronic stability control.

Yes, it does not display the rawness and the scary ferocity of earlier air-cooled 911s, but for many, that is a good thing. There is a lot of negative publicity surrounding the engine’s IMS bearing (intermediate shaft) and a propensity for cracked heads, but the phenomena are not nearly as widespread as the internet would lead you to believe.

Engine

The dreaded Intermediate Shaft bearing discourages many people from buying a 996. The intermediate shaft drives the camshaft from the crankshaft, and inferior bearings were initially used; when starved of oil, the bearing fails, thus causing catastrophic engine failure (pistons hitting valves). A rebuild after such damage may cost as much as 10,000 euros or more, but only 8% of the cars produced were affected; please check for proof that this has been rectified. It is assumed that if the defect (which gives no prior warning!) has not appeared up to a mileage of 80,000 kilometers or more, it is unlikely to appear: but it’s better to be sure the work has been done.

Cracking cylinder heads are less widespread than people think, and a borescope inspection can set your mind at ease. Despite internet rumors, also cars with higher mileages can suffer from this, and the later 3.6-liter engine is not immune either. The engine in the GT3, GT2 and Turbo is based on a different block and is not affected by the head cracking problem.

Cars that have been left standing for long periods of time suffer from all kinds of problems. Exhausts corrode. lambda sensors and air mass sensors are often faulty.

Gearbox

Neither the manual gearbox nor the Tiptronic is known to suffer from any serious problems. Listen for unusual noises during the test drive, and check the maintenance records.

Bodywork

Cars that have driven all year round, including on salt-covered roads in winter, may have corrosion on the floor. Rust may also appear in the front fenders, but this is almost always an indication of unprofessionally repaired collision damage. A car that has not been used regularly can suffer from various corrosion issues related to condensation.

The front-mounted radiators and coolers suffer stone and other debris damage, and they also corrode, usually because leaves are left to rot in the radiator openings. Replacements are necessary, and not very cheap. Driving around with damaged or blocked radiators can cause the engine to overheat, with permanent damage as a result.

Headlamp lenses go cloudy and must be polished or replaced.

Chassis

Unless the car has been crashed and badly repaired, the suspension should be in good shape. Replace all bushes and shock absorbers for peace of mind and for a safe driving experience. If control arms squeak, they may need replacement, but it is not prohibitively expensive. Check that correct parts have been used for brakes etc.

Interior

The company was cash-strapped at the time of the start of 996 productions, so many interior plastics were of inferior quality, and it shows. They display wear and look cheap. Check all switchgear, make sure everything works. The PCM navigation/infotainment system of the first generation was horrible and rarely worked even when new. Thin leather of lower quality was used for seat trim, and it has a tendency to stretch and wear out in a nasty way, especially on the driver’s seat. The interior was facelifted in 2002, and from that time onwards better quality plastics were used.

History

1997: The 996 series launched in Frankfurt in September

1998: Carrera Cabriolet available, followed by the AWD Carrera 4, equipped with the Porsche Stability Management (PSM)

1999: the first GT3 is launched, with a high-revving 360 hp engine

2000: Turbo launched with 420 hp, followed by the GT2 with 462 hp

2001: facelift, new headlights, improved interior. The 320-hp 3.6-liter engine replaces the 300-hp 3.4-liter unit. Carrera 4S and Targa was shown.

2002: factory power hike to 345 hp available, more power for GT3 and GT2

2003: Turbo also available as Cabriolet. GT3 RS homologation model launched

2004: 911 Turbo S with 450 hp launched

2005: end of production in July, replacement by 997

How much to pay

• Project: €20,000 – €25,000

• Good: €29,000 – €100,000

• Special series: €90,000 – €330,000 (GT2,3)

The DRIVERSHALL Verdict

The underrated 996 is a great entry-level Porsche 911, very good to drive on the road every day, and able to acquit itself on a track as well. Maintenance records and an inspection by a specialist are crucial. If the heads show no sign of cracking, and the IMS bearing issue has been addressed, the car can potentially be a source of fun for many years to come. The GT3 is very special, a precision tool for track work, much more rewarding to drive than the frighteningly rapid GT2.

Images: Porsche AG, Newspress, Tom Wood ©2016 Courtesy of RM Sotheby’s, Remi Dargegen ©2018 Courtesy of RM Sotheby’s